The 2024 Becker Forum was hosted by New York State Vegetable Growers Association on Monday, January 22, 2024. At the event, recent changes to the H-2A program were discussed in detail, including from U.S. Department of Labor’s senior H-2A administrator, Mr. Brian Pasternak. Mr. Pasternak shared incredibly important information with the audience and I want to revisit a few key points here. Much of this message is good news, especially the fact that most H-2A jobs will still fit into the traditional AEWR pay rates. However, employers must carefully describe jobs by using the task language from O*NET as detailed later in this message. Note that everything presented here is for education purposes only and is not legal opinion.

U.S. DOL issued a “Final Rule” effective November 2022 that changed how program wage rates apply to some H-2A jobs. Essentially, it makes certain H-2A jobs such as supervisors, mechanics, some heavy truck drivers, and other jobs subject to wage rates that reflect the broader economy, not just farm jobs. These wages come from the U.S. Bureau of Labor Statistics’ Occupation Employment Wage Survey (OEWS). Generally, these OEWS wages are higher than the farm AEWR wages, so employers are keen to keep most H-2A jobs under the farm AEWR. The following slides are from Mr. Pasternak’s presentation. The column on the left shows the “Big 6” farm jobs with standard occupation classification (SOC codes) that remain under the farm AEWR rates.

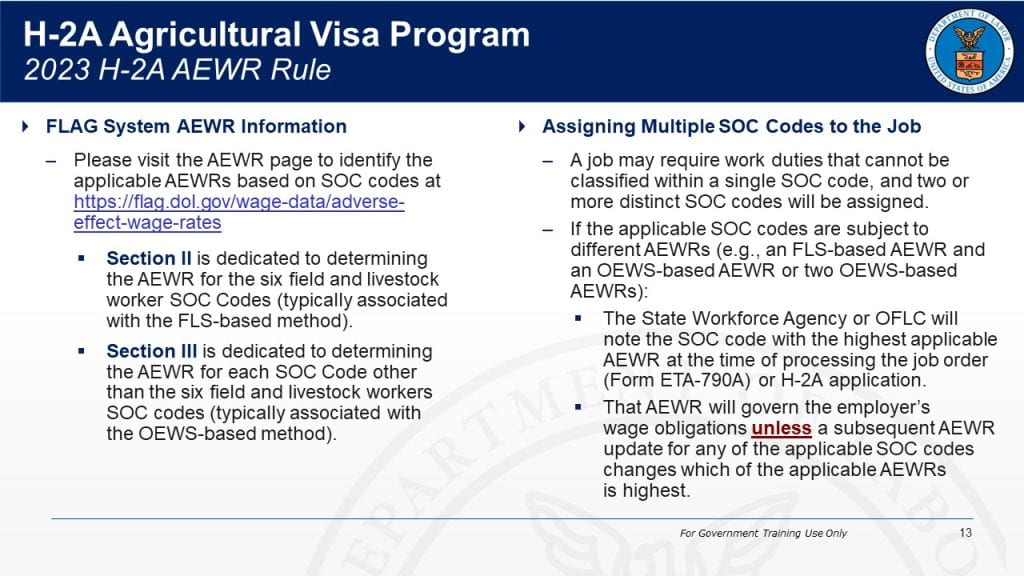

The slide below provides a link to the USDOL website that provides the current AEWR and OEWS wages. In the right column it explains that one H-2A job requested by an employer, depending on the job tasks required, could be subject to more than one SOC code. H-2A employers must be very careful about the tasks they list in the job description for H-2A jobs, because these tasks will be used the state and federal agencies to determine which SOC codes apply, and thus which wage rates.

Following are a few examples of the different H-2A wage rates that could be applied in New York. Note that if a higher wage rate is applied, then that rate must be paid for every hour that an employee works, not just when they are performing the higher skill task.

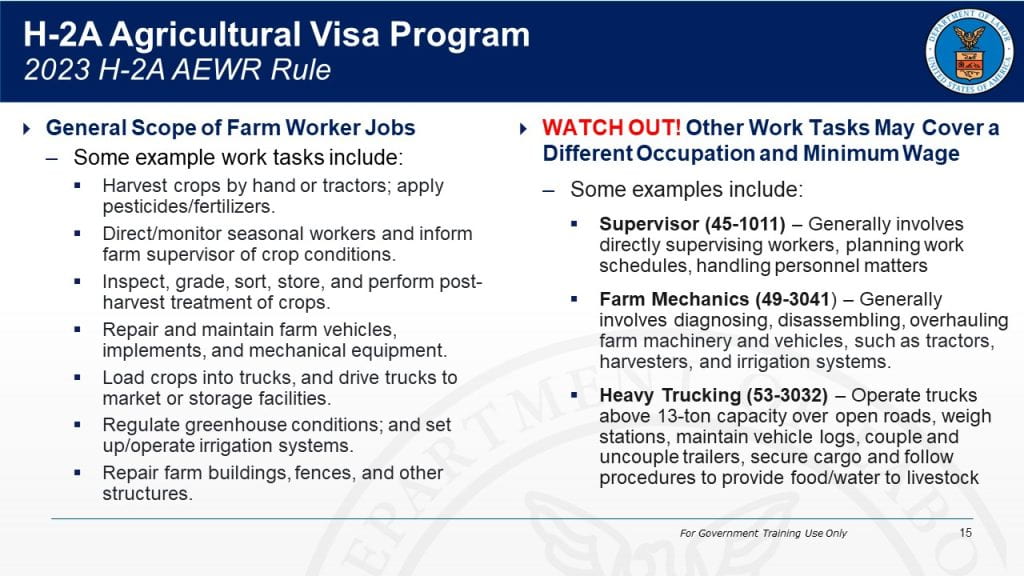

Certainly, the OEWS wages are higher than the FLS-based AEWRs, for this reason, it is important for employers to carefully and accurately describe their positions in their H-2A applications. Fortunately, the vast majority of farm jobs should still fit under the Big 6 SOC codes. The slide below shows typical tasks in the left column that are all under the Big 6, in the right column it shows tasks that would likely move the job into the higher-paid OEWS category.

It is important for employers to become familiar with SOC codes and the descriptions found in O*NET Online, because this is where the job descriptions and specific task lists for certain jobs can be found. Employers can directly use the words from the O*NET descriptions to describe the jobs in their H-2A applications. Following are direct links to O*NET descriptions of the Big 6 agricultural jobs:

- 45-2041: Graders and Sorters

- 45-2091: Agricultural Equip. Operators

- 45-2092: Farmworkers and Laborers

- 45-2093: Farmworkers, Farm, Ranch, and Aquacultural Animals

- 45-2099: All Other Agricultural Workers

- 53-7064: Packers and Packagers

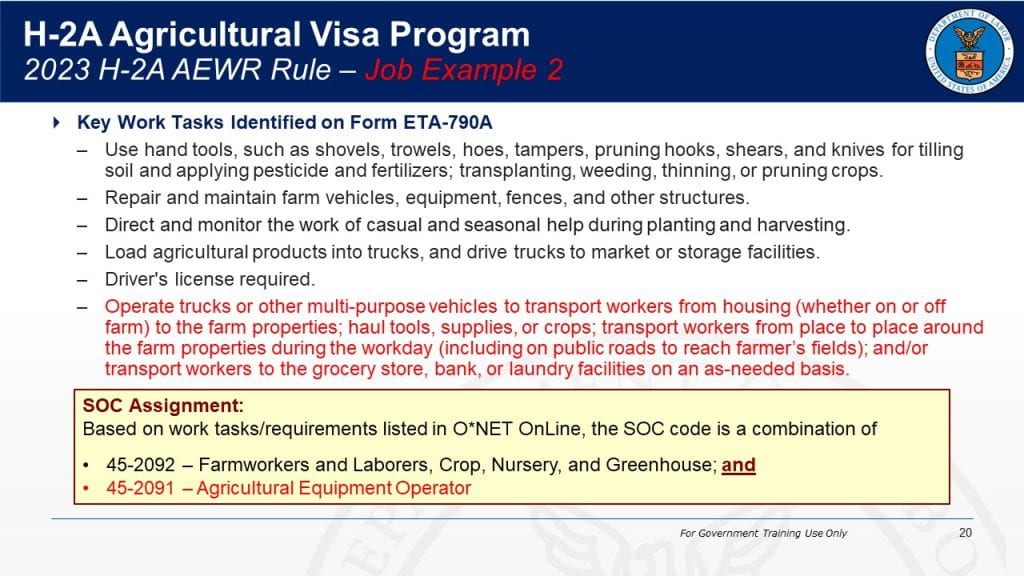

The slide below provides directions to O*NET Online in the left column. In the right column it focuses on drivers and encourages employers to provide details about any driving duties listed.

Mr. Pasternak shared a clear example in the slide below that most driving duties in H-2A jobs should fit into the Big 6. The red text below describes most driving duties and would fit into SOC codes 45-2092 and 45-2091. Now, if a worker was assigned to drive a regular bus route for other H-2A workers, or required to have CDL and deliver farm product over-the-road to distant deliver points, then these would likely be driving duties that fall outside of the Big 6 codes.

In summary, the Becker Forum communicated a lot of critical information this year. Much of it was good news clarifying that most H-2A work will fit into the Big 6 codes. Work closely with your H-2A advisors to accurately describe jobs in your applications. If you believe a job should fit into the Big 6, and all the tasks can be found in the Big 6 descriptions in O*NET, then be sure to insist on this position if the NYS Department of Labor makes a different determination or denies your application, you can also appeal to USDOL.

_________________________________________________________________________________

By Richard Stup, Cornell University. Permission granted to repost, quote, and reprint with author attribution.

The post H-2A Wage Rates & SOC Codes Explained appeared in The Ag Workforce Journal.